Grow Wealth Effortlessly with Luxury Short Term Rentals

Invest Passively in Diversified Short-Term Rentals in Texas

Invest Passively In The Stronex Fund

- Get 7-12% Annual Cash Flow

- Gain Tax Advantages and Diversification

- Projected ROI of 80 - 120% Over 60-72 Months

Grow Wealth Effortlessly with Luxury Short Term Rentals

Invest Passively in Diversified Short-Term Rentals in Texas

Invest Passively In The Stronex Fund

- Get 7-12% Annual Cash Flow

- Gain Tax Advantages and Diversification

- Projected ROI of 80 - 120% Over 60-72 Months

Key Highlights

Projected ROI of 80-120% over 60-72 months.

7-12% cash flow annually, with tax advantages passed directly to you.

Conservative leverage (≤50%) for low-risk, steady returns.

Minimum Investment Of $50,000

Experienced founders driving diversification

Flexibility to liquidate your investments

Projected ROI of 80-120% over 60-72 months.

7-12% cash flow annually, with tax advantages passed directly to you.

Conservative leverage (≤50%) for low-risk, steady returns.

Minimum Investment Of $50,000

Experienced founders driving diversification

Flexibility to liquidate your investments

Projected ROI of 80-120% over 60-72 months.

7-12% cash flow annually, with tax advantages passed directly to you.

Conservative leverage (≤50%) for low-risk, steady returns.

Minimum Investment Of $50,000

Experienced founders driving diversification

Flexibility to liquidate your investments

A diversified portfolio of properties designed for premium, wellness-focused experiences.

Fill Out The Form And Explore More About The Stronex Fund

Benefits For Investors

Passive real estate investment

Consistent cash flow

Potential equity growth

Diverse exposure in multi-property STR portfolio

Tax benefits of real estate investing

One Of Our Fund Location

In The Amazing Fredericksburg, TX

Why Investor Should Invest In Our Luxury Landscapes?

Unique Destinations

Rentals blending privacy, nature, and design to meet high guest demand.

Passive Investment

Reap the benefits of a managed, diversified portfolio—hassle-free.

High-Demand Market

Capitalize on the growing trend of upscale, experience-driven short-term rentals.

Exclusive Opportunity

Join a visionary plan redefining luxury short-term rentals.

Our Vision and plan is to create unique, high-end escapes that merge privacy and nature with design-forward structures, offering guests exceptional experiences. From private plunge pools to high-end interiors and outdoor fireplaces, our projects provide unparalleled relaxation and exclusivity. These aren’t just rentals—they’re experience-based destinations that will be in high demand.

Why Invest In Luxury Short-Term Rentals With Stronex NOW

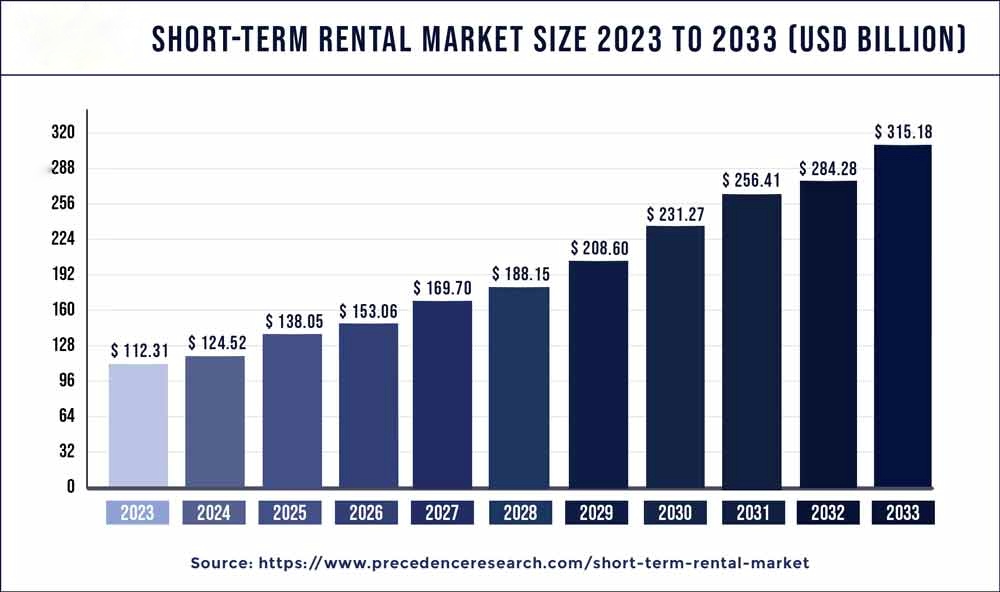

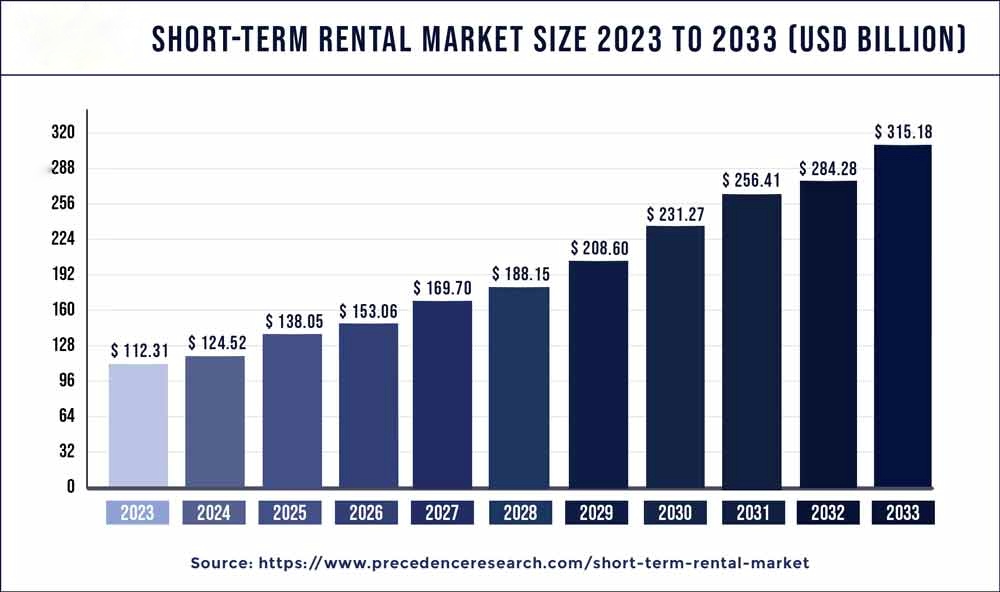

Short-term rentals have become a fast-growing asset segment, driven by a 30% increase in demand for experience-based luxury stays, with the market projected to grow from $82.63 billion in 2022 to $231 billion by 2030.

Offering 2 to 3 times higher ADR and over 70% occupancy rates, short-term rentals are outperforming long-term investments in yield.

Despite this growth, over 99% of properties are still managed by amateurs, leaving tremendous opportunity for professional strategies to capitalize on this rising demand.

Our data-driven approach, combined with our financial and real estate expertise, allows us to stand out in this fragmented market.

Why Invest In Luxury Short-Term Rentals With Stronex NOW

Short-term rentals have become a fast-growing asset segment, driven by a 30% increase in demand for experience-based luxury stays, with the market projected to grow from $82.63 billion in 2022 to $231 billion by 2030.

Offering 2 to 3 times higher ADR and over 70% occupancy rates, short-term rentals are outperforming long-term investments in yield.

Despite this growth, over 99% of properties are still managed by amateurs, leaving tremendous opportunity for professional strategies to capitalize on this rising demand.

Our data-driven approach, combined with our financial and real estate expertise, allows us to stand out in this fragmented market.